:max_bytes(150000):strip_icc()/what-is-unemployment-3306222_FINAL-blank-d5eae495a96a485a9f2940abc7542df6-b7a8b9905ef843858d4e50fad2b1c170.png)

The U.S. Last week, the number of Americans submitting new jobless claims surged more than predicted. Nonetheless, the underlying trend pointed to a tight labor market.

Despite mounting economic headwinds from the Federal Reserve’s interest rate rises, the labor market has remained robust. While labor market growth maintains the U.S. central bank’s tightening course, it also signals that the much-anticipated recession is not on the horizon.

“We’d be screaming wolf if we said we felt the weekly jobless claims numbers this week showed a recession signal,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “With layoffs this low, a recession is not on the corner, and the downturn, if it comes at all, will be months away.”

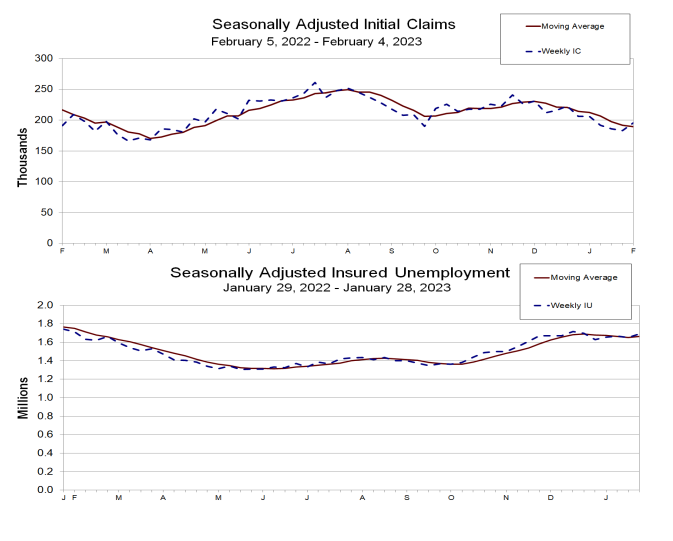

The Labor Department said on Thursday that initial claims for state unemployment benefits increased 13,000 to a seasonally adjusted 196,000 for the week ending Feb. 4. The gain was the first since the second final week of December.

The four-week moving average of claims, considered a stronger indicator of labor market trends since it eliminates week-to-week volatility, declined from 2,500 to 189,250, the lowest level since April last year. Last week, unadjusted claims increased from 9,628 to 234,654.

Claims increased in California, with substantial increases in Ohio and Illinois. These increases more than offset declines in Georgia, New Jersey, and Texas.

Despite high-profile layoffs in the I.T. industry and the interest-rate-sensitive financial and housing sectors, claims have remained low. This week, Walt Disney (DIS.N) and Zoom Video Communications (ZM.O) joined the expanding list of firms laying off employees, announcing 7,000 and 1,300 job layoffs, respectively.

According to economists, most businesses, particularly those in the technology sector, overhired during the COVID-19 epidemic. They observed that small enterprises were still looking for employees.

Anecdotal information suggests employers often hesitate to lay off staff after having difficulty hiring during the epidemic.

In certain sectors, workers are still scarce. According to official figures released this week, there were 1.9 job vacancies for every jobless individual in December. According to an Institute for Supply Management poll released last Friday, some service organizations reported being “unable to acquire competent workers” in January, citing “supply being thin.”

Stocks in the United States began the day higher. The dollar dropped in value versus a basket of currencies. Treasury prices in the United States increased.

Heavy Employment Market

Economists hypothesized that severance bonuses delayed the filing of unemployment claims, while the number of vacancies made it simpler for laid-off people to obtain work.

“If the employer gives severance, the claims are not included until the severance ends,” Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania, said. “However, the labor market remains exceptionally robust.”

Economists also argued that seasonal adjustment variables, the government’s technique for removing seasonal changes from data, contributed to reduced claims.

At the end of March, the seasonal adjustment parameters for 2023 will be revised. According to Conrad DeQuadros, senior economic adviser at Brean Capital, using the average seasonal components for the previous two years with the same calendar configuration as 2023 would result in claims of 210,000 in the most recent week and a four-week average of 200,000.

“However, this would still be a low claim reading and imply that either involuntary separations remain minimal or people who leave their employment are promptly re-employed elsewhere,” DeQuadros added. “There is no hint of the job market loosening here.”

The number of persons getting benefits after an initial week of help, a proxy for hiring, increased by 38,000 to 1.688 million for the week ending Jan. 28.

Lower layoffs have contributed significantly to good employment increases. Last Friday, the government announced that nonfarm payrolls increased by 517,000 in January, the largest in six months, after a 260,000 rise in December. The jobless rate decreased to 3.4%, a more than 53-1/2-year low, from 3.5% in December.

On Tuesday, Fed Chair Jerome Powell suggested that the central bank’s effort to manage inflation might endure “quite a bit of time” about January’s blockbuster job gains. Since March, the Federal Reserve of the United States has raised its policy rate by 450 basis points, from near zero to the 4.50%-4.75% level.